Responsible For An Sell Products From Home Uk Budget? 12 Best Ways To …

페이지 정보

작성자 Jack 메일보내기 이름으로 검색 작성일24-04-23 23:09 조회8회 댓글0건관련링크

본문

How to Sell Products From Home in the UK

Selling on marketplaces gives you access millions of potential customers. eBay is the most well-known marketplace, with fixed-price and auction-style sales with a low fee for sellers and tools such as pre-set templates.

Online shoppers can pay for their purchases using PayPal, credit or debit cards. You must also comply with ecommerce laws and regulations including the inclusion of VAT in prices and providing information on shipping costs and delivery times.

Online shoppers can pay for their purchases using PayPal, credit or debit cards. You must also comply with ecommerce laws and regulations including the inclusion of VAT in prices and providing information on shipping costs and delivery times.

Inventory

Making money selling products from home can be a great way of boosting your income. Whether you want to sell your own products, branded t-shirts, or eco-friendly reusable bags There are a variety of options for you. It is essential to select products in high demand and that can be shipped easily. This will ensure that your customers receive an enjoyable experience and will purchase from you again. You will need a dedicated space to store your items and prepare for shipping. Investing in your own dedicated space at home can allow you to be more productive and lessen distractions.

In addition to a dedicated space you will also require an efficient computer, internet connection as well as office equipment and mail supplies. Based on the type of business, you may also need to adhere to local laws and regulations. If you sell food products, you must follow strict regulations regarding food safety and labelling.

You can manage your product inventory in the UK through marketplaces on the internet like Amazon or Etsy. These marketplaces offer a range of tools for e-commerce and can provide millions of potential buyers. However, it is important to be aware of the potential risks of using a third-party service. For instance, you could, be at risk of data breaches or not have control over the data of your product.

Marketing

The UK is a highly developed and competitive consumer market. Its consumers are comfortable making online purchases, and many major brands are already present there. Before launching your product in the country, you must consider the challenges. You must consider the type of product you are selling, how much it costs to ship to the UK and whether the local currency is acceptable for your customers. It is also important to ensure that your website is optimized for the country, which includes its language and cultural sensitivities.

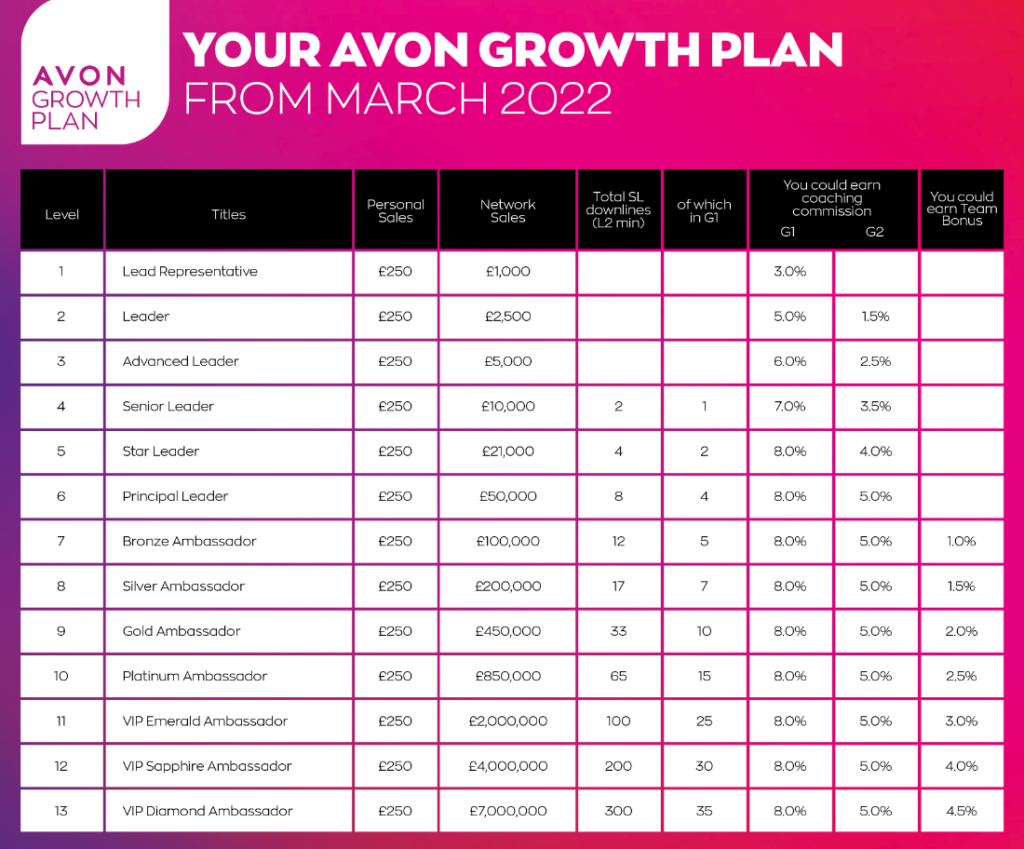

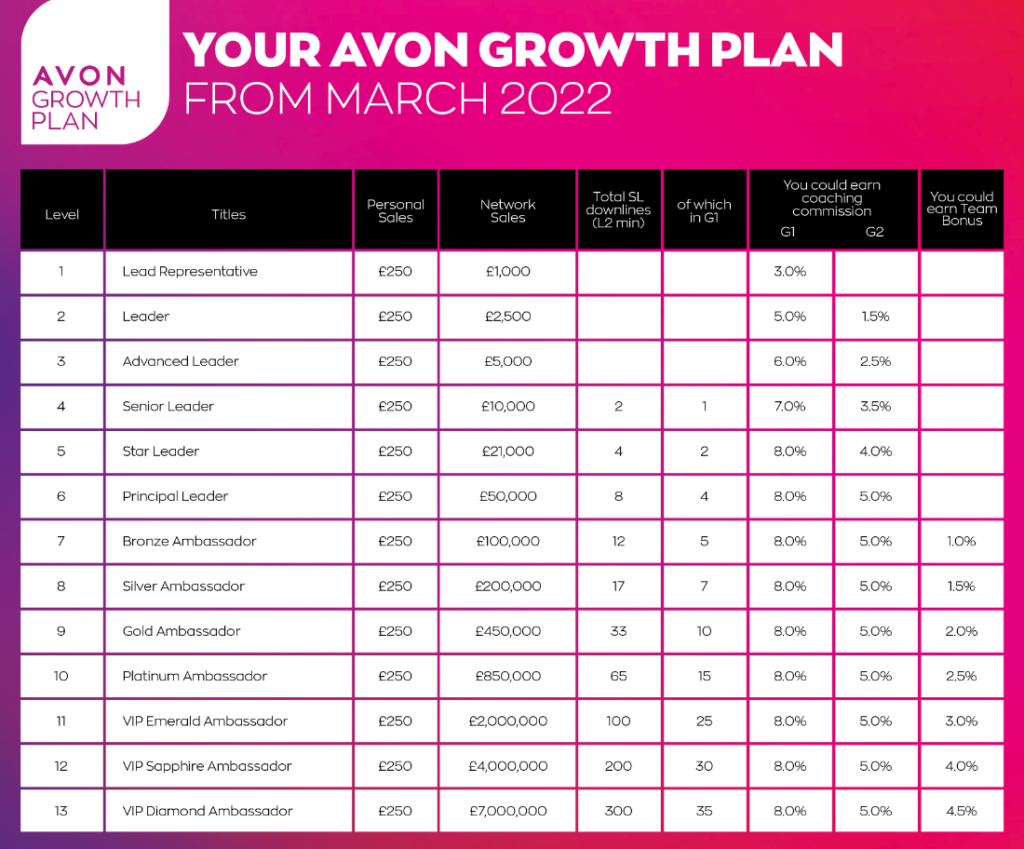

If you intend to sell avon cosmetics your products directly via your own website, you must choose the right product and price to appeal to your market. The product must be in demand easy to ship and capable of adding a reasonable markup for you to make an income. It is also necessary to find a suitable place to store your inventory and also have access to a reliable internet connection and office equipment. It is possible that you will require additional staff to run the company and manage customer service issues.

Solving this problem is a common task for many home-based ecommerce businesses. They sell through third-party marketplaces such as Amazon and Etsy. These platforms provide ready-to-use tools for ecommerce and a large number of customers. They also provide a range of shipping options and payment options. These platforms can cut down on the amount of inventory you have and shipping costs, allowing you more time on marketing and other business-related tasks.

It is essential to ensure that all taxes and sell avon Cosmetics fees for your product are calculated and displayed to customers up front. This is a crucial step that can be performed manually or automatically with a third-party program like Glopal's HS Classification Solution. This will enable you to provide a seamless buying experience for your UK-based customers and ensure that all taxes and sell avon cosmetics duties are paid at the time of checkout.

Legal requirements are an additional aspect to consider when running your business from home in the UK. You must adhere to all applicable laws and regulations. This includes data protection. You must also prove you have the ability to run your business and have the necessary assets and income.

Shipping

The most important factor to success in your business is selecting the right products to sell. It is important to select products that are in demand and easy to ship and with a high enough margin to generate a profit. You should also consider your shipping costs and taxes when determining your price point. It is also recommended to have a space at home that is dedicated to storing your inventory and packaging your items for shipping. The clutter of your living space with boxes is not ideal and it could be difficult to keep the track of your inventory.

Ecommerce sales remain strong in the United Kingdom, with double-digit growth expected in the coming years. This makes the UK an ideal market for online businesses to focus on. Shipping to the United Kingdom is not easy due to customs, VAT and other costs. However, there are many ways to get around these hurdles and optimize your shipping strategy.

The first step is to create an account with marketplaces like Amazon or eBay. These platforms provide a range of tools that will assist you in managing your inventory online and connect with potential customers. Once you have set up your account, you can start listing your products and taking orders. You can utilize a shipping software to automate and keep track of your orders.

A shop on your site is a different option for selling online. This can you make money selling avon be a fantastic way to reach a global audience and increase sales. However, it is important to have a website that is secure and user-friendly. Also, ensure that your website is optimized for mobile devices.

Once you have created your website, you must think about the various options for shipping. You can choose whether to ship your product by air, sea or via road. If you are shipping to an extensive area it is likely to be cheaper shipping via sea. For smaller areas, you could use a service like Sendle or Australia Post. Whichever method you select, be sure to communicate your shipping details clearly to your customers so that they don't get a shock by additional costs.

Taxes

Online sales can be lucrative, but you must be aware of all the taxes that go along with them. In addition to the tax that is paid on shipping, sellers may be required to pay for value-added tax (VAT) and import duty. Reporting and filing also incurs additional compliance costs. There are tools to simplify the process.

The VAT rate in the UK is 20 percent, and it is important to factor this into your pricing structure. In addition, you must be aware of the requirements to import goods from abroad. These rules could impact the cost of shipping and may require you to charge a different amount at checkout.

Additionally, it is crucial to know the HS code of your products. This system is used to identify the product's contents, so that tariffs and taxes from abroad can be applied correctly to shipments. The World Customs Organization offers resources to find out more about the HS code, and also to locate the one that's applicable to your product.

If you're a retailer in the EU you must be registered for VAT when your total sales to EU clients exceed a certain threshold. This will permit you to collect and remit the VAT on all of your EU sales. You can register for VAT online.

You will have to adhere to the VAT laws of the region or country in which your customers reside if you're outside the EU. These laws may include requirements to have a local presence or register as a business in that country. It is recommended to contact your tax authority or local tax professional for more information.

US sales tax can be somewhat complicated, but it's essential to be aware of the rules and regulations. Depending on the products you offer, you may be required to pay state sales tax and local sales tax. Many tools are available to calculate the US sales tax. Additionally it's a good idea to set up an account at a bank in the country where you're selling. This will reduce your risk of fraud and money laundering.

Selling on marketplaces gives you access millions of potential customers. eBay is the most well-known marketplace, with fixed-price and auction-style sales with a low fee for sellers and tools such as pre-set templates.

Online shoppers can pay for their purchases using PayPal, credit or debit cards. You must also comply with ecommerce laws and regulations including the inclusion of VAT in prices and providing information on shipping costs and delivery times.

Online shoppers can pay for their purchases using PayPal, credit or debit cards. You must also comply with ecommerce laws and regulations including the inclusion of VAT in prices and providing information on shipping costs and delivery times.Inventory

Making money selling products from home can be a great way of boosting your income. Whether you want to sell your own products, branded t-shirts, or eco-friendly reusable bags There are a variety of options for you. It is essential to select products in high demand and that can be shipped easily. This will ensure that your customers receive an enjoyable experience and will purchase from you again. You will need a dedicated space to store your items and prepare for shipping. Investing in your own dedicated space at home can allow you to be more productive and lessen distractions.

In addition to a dedicated space you will also require an efficient computer, internet connection as well as office equipment and mail supplies. Based on the type of business, you may also need to adhere to local laws and regulations. If you sell food products, you must follow strict regulations regarding food safety and labelling.

You can manage your product inventory in the UK through marketplaces on the internet like Amazon or Etsy. These marketplaces offer a range of tools for e-commerce and can provide millions of potential buyers. However, it is important to be aware of the potential risks of using a third-party service. For instance, you could, be at risk of data breaches or not have control over the data of your product.

Marketing

The UK is a highly developed and competitive consumer market. Its consumers are comfortable making online purchases, and many major brands are already present there. Before launching your product in the country, you must consider the challenges. You must consider the type of product you are selling, how much it costs to ship to the UK and whether the local currency is acceptable for your customers. It is also important to ensure that your website is optimized for the country, which includes its language and cultural sensitivities.

If you intend to sell avon cosmetics your products directly via your own website, you must choose the right product and price to appeal to your market. The product must be in demand easy to ship and capable of adding a reasonable markup for you to make an income. It is also necessary to find a suitable place to store your inventory and also have access to a reliable internet connection and office equipment. It is possible that you will require additional staff to run the company and manage customer service issues.

Solving this problem is a common task for many home-based ecommerce businesses. They sell through third-party marketplaces such as Amazon and Etsy. These platforms provide ready-to-use tools for ecommerce and a large number of customers. They also provide a range of shipping options and payment options. These platforms can cut down on the amount of inventory you have and shipping costs, allowing you more time on marketing and other business-related tasks.

It is essential to ensure that all taxes and sell avon Cosmetics fees for your product are calculated and displayed to customers up front. This is a crucial step that can be performed manually or automatically with a third-party program like Glopal's HS Classification Solution. This will enable you to provide a seamless buying experience for your UK-based customers and ensure that all taxes and sell avon cosmetics duties are paid at the time of checkout.

Legal requirements are an additional aspect to consider when running your business from home in the UK. You must adhere to all applicable laws and regulations. This includes data protection. You must also prove you have the ability to run your business and have the necessary assets and income.

Shipping

The most important factor to success in your business is selecting the right products to sell. It is important to select products that are in demand and easy to ship and with a high enough margin to generate a profit. You should also consider your shipping costs and taxes when determining your price point. It is also recommended to have a space at home that is dedicated to storing your inventory and packaging your items for shipping. The clutter of your living space with boxes is not ideal and it could be difficult to keep the track of your inventory.

Ecommerce sales remain strong in the United Kingdom, with double-digit growth expected in the coming years. This makes the UK an ideal market for online businesses to focus on. Shipping to the United Kingdom is not easy due to customs, VAT and other costs. However, there are many ways to get around these hurdles and optimize your shipping strategy.

The first step is to create an account with marketplaces like Amazon or eBay. These platforms provide a range of tools that will assist you in managing your inventory online and connect with potential customers. Once you have set up your account, you can start listing your products and taking orders. You can utilize a shipping software to automate and keep track of your orders.

A shop on your site is a different option for selling online. This can you make money selling avon be a fantastic way to reach a global audience and increase sales. However, it is important to have a website that is secure and user-friendly. Also, ensure that your website is optimized for mobile devices.

Once you have created your website, you must think about the various options for shipping. You can choose whether to ship your product by air, sea or via road. If you are shipping to an extensive area it is likely to be cheaper shipping via sea. For smaller areas, you could use a service like Sendle or Australia Post. Whichever method you select, be sure to communicate your shipping details clearly to your customers so that they don't get a shock by additional costs.

Taxes

Online sales can be lucrative, but you must be aware of all the taxes that go along with them. In addition to the tax that is paid on shipping, sellers may be required to pay for value-added tax (VAT) and import duty. Reporting and filing also incurs additional compliance costs. There are tools to simplify the process.

The VAT rate in the UK is 20 percent, and it is important to factor this into your pricing structure. In addition, you must be aware of the requirements to import goods from abroad. These rules could impact the cost of shipping and may require you to charge a different amount at checkout.

Additionally, it is crucial to know the HS code of your products. This system is used to identify the product's contents, so that tariffs and taxes from abroad can be applied correctly to shipments. The World Customs Organization offers resources to find out more about the HS code, and also to locate the one that's applicable to your product.

If you're a retailer in the EU you must be registered for VAT when your total sales to EU clients exceed a certain threshold. This will permit you to collect and remit the VAT on all of your EU sales. You can register for VAT online.

You will have to adhere to the VAT laws of the region or country in which your customers reside if you're outside the EU. These laws may include requirements to have a local presence or register as a business in that country. It is recommended to contact your tax authority or local tax professional for more information.

US sales tax can be somewhat complicated, but it's essential to be aware of the rules and regulations. Depending on the products you offer, you may be required to pay state sales tax and local sales tax. Many tools are available to calculate the US sales tax. Additionally it's a good idea to set up an account at a bank in the country where you're selling. This will reduce your risk of fraud and money laundering.

댓글목록

등록된 댓글이 없습니다.